Three of Canada’s six largest banks are among the lenders who have been reducing fixed rates on mortgages. This is a good sign for anyone facing re-financing in the near future.

We are a team of professionals who can help you. Last week’s reportLenders had begun reducing rates after a drop of nearly 40 basis points in bond yields. Fixed mortgage rate pricing is typically based on the bonds’ yields.

The big three banks did not make any significant rate changes at the time. However, they all reduced their special mortgage rates this week. According to Data from, the rate reductions averaged 10-15 basis points but sometimes exceeded 20 bps (0.20%). MortgageLogic.news.

In a post on social media, Ron Butler from Butler Mortgage stated that “it’s good news for those who renew.”

Mortgage Professionals Canada’s most recent survey revealed that 76% of those who are renewing their mortgages in the next 12 months are concerned about the renewal process. consumer survey.

Rates are moving from a majority of rates above 5% to a majority in the 4% range. [4%-range],” Butler noted.

Butler states that while shorter term fixed rates like 1-year and 2-year will continue to be higher priced, most 3-year and 5-year options are available at less than 5%.

Butler states that there are 5-year fixed high-ratio rates (less than 20% deposit) available at 4.50%. However, those renewing their mortgages and who require a non-insured loan (more than 20%), can expect to pay rates between 4.79% and 4.99%.

The bottom line: relief is finally on the way. He said, “Praise be.”

Why are mortgage rates falling?

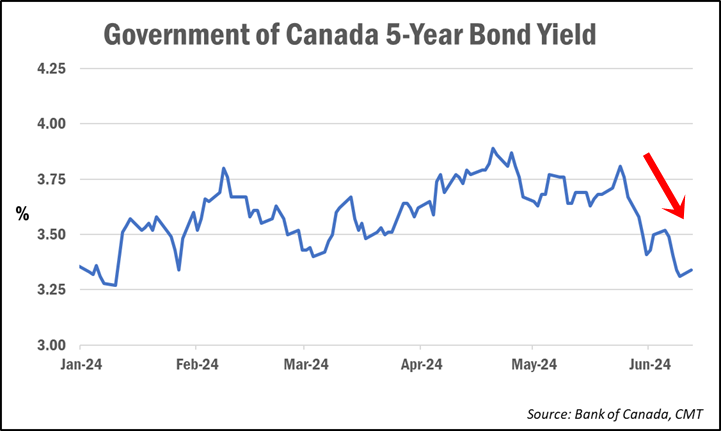

Rate reductions are a result of a continuing decline in Canadian Bond Yields.

Bruno Valko is Vice President, National Sales, at RMG. He told CMT that the movement coincides largely with movements similar south of the Border, as both markets are reacting to recent lower than expected inflation in Canada and U.S.

As the 10-year [U.S.] “The 5-year Government of Canada Yield follows the Treasury Yield,” he stated.

Rates could be more differentiated between lenders

Expert in mortgage brokering and rates Ryan Sims This latest round of rates cuts is expected to start allowing for some differentiation between the rate prices charged by lenders.

He told CMT that “everyone has different risks, exposures and profit targets for their mortgage books.” For the first time, I believe, lenders will offer a wide spread on the same rates.

In pursuit of higher margins, he expects that some lenders will concentrate on mortgages which are insurable, and others will offer uninsurable loans.

He said, “It’ll be interesting to watch how this plays out, but at least the lenders are going to have a new spread that we haven’t seen in a long time.”

Sims, who is reluctant to predict where rates will go from here, suggests that we may see continued rate decreases in the coming 30-60 days with a possible pullback due to poor economic data.

Like waves in the ocean, our rates go up and down but are range bound at a floor around 3.05%, and a maximum of 3.75%. [for the 5-year bond yield]”, he added. We will continue to follow this pattern until we have definitive data that shows us how we can break free of the range.

The borrower must “fight” to get a good rate when renewing the loan

The falling mortgage rate could soften payment shocks for the estimated 2,2 million mortgages which will renew at a higher rate in the next 2 years.

Butler cautions, however, that even though mortgage rates may be falling, it doesn’t necessarily mean that all lenders are going to offer the same low rate in their renewal letter.

If you have a renewal due, they’ll send you a notice with a high interest rate. You’ll need to take action. [and argue] “Rates are going down,” said he. They don’t simply hand out money. [out their best rates]. “You’ve got do some research.”

Butler suggests that borrowers use rate comparison websites to better understand the rates available in other places. The information you gather can be leveraged to negotiate with your current lender even if it is not your intention to switch.

It appears that homeowners do less haggling when renewing their mortgages, even though interest rates are higher. MPC’s study, cited earlier, revealed that At renewal, 41% of the borrowers accept their initial interest rate..

Only 8% of respondents said that they had “significantly” reduced their renewal rate.

The fact that many people are “trapped” in their current rate because of the stress test for mortgages is a major factor.

When switching lenders, the Office of the Superintendent of Financial Institutions applies the Mortgage Stress Test to uninsured customers. The Office of the Superintendent of Financial Institutions (OSFI) applies a mortgage stress test to uninsured borrowers when switching lenders.

Peter Routledge, the OSFI director, was just last week. rejected The call to eliminate the stress test for uninsured loans has been renewed.

From our point of view, we find the rules – from an underwriting perspective – to be reasonable. “If you are taking credit risks anew you will be reunderwriting,” said he.