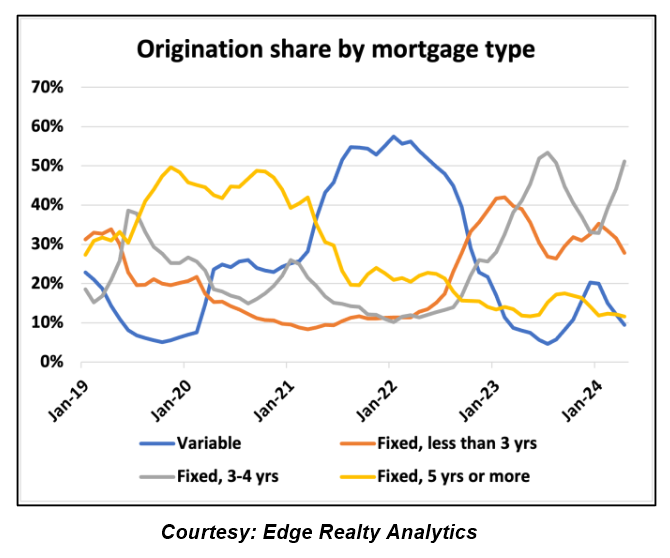

As the Bank of Canada lowers interest rates, mortgage borrowers will continue to opt for variable rate mortgages.

According to Bank of Canada figures, as of the first quarter of this year, 12,9% of all new mortgages borrowers chose a variable rate mortgage.

This is up from the low 4.2% of the third quarter 2023 but it’s down from the peak 57% reached when the pandemic was in full swing and most products with variable rates cost less than those fixed rate.

Variable-rate mortgages are those where interest rates can fluctuate over time. Typically, they’re based on the overnight rate of the Bank of Canada.

Recent data shows that the demand for variable rate mortgages has declined in the past few months, just before the Bank of Canada quarter-point increase. Rates reduced in JuneTheir share of originations is up by 50% from last year.

Ben Rabidoux, of Edge Realty Analytics noted that “for context”, they only accounted for 9% of the total number of originations for April 2022 and 90% less than in April 2019.

In the coming months, it is expected that variable-rate loans will regain more of their originations.

In his monthly newsletter, he said: “I expect we will see an increase in variable originations over the next couple of months as it becomes apparent that the Bank of Canada is really on a serious cycle of rate cuts.”

Shorter fixed-rate mortgages, which combine a competitive rate with a shorter period, are the preferred choice for many borrowers today. In April, more than half of all new mortgages borrowers chose a fixed-term term between 3 and 4 years.

Bank of Canada data also revealed that the growth in mortgage credit reached its lowest level of 3.4% for 24 years during this month.

OSFI’s view on risk management

The aforementioned is a Recent webcastThe head of Canada’s banking regulator, said that proactive risk management is important for financial stability.

Peter Routledge is the head of the Office of the Superintendent of Financial Institutions. He said, “We’d rather be criticized for acting prematurely and aggressively than for reacting too late.” It is important to maintain stability within the Canadian financial system by taking a proactive approach.

OSFI has a role to play in mitigating these risks. He said that because the financial system is so interconnected, weaknesses can spread quickly.

He said, “Our role at OSFI involves making sure everyone in our jurisdiction is well-prepared to handle shocks.” I would say that the shocks we were afraid of last year did not materialize. “I hope that I will be able to say the same next year.”

Routledge touched upon the issue of high interest rates, which have been a challenge for households and business. This has required vigilance in regulatory measures that maintain financial stability.

This includes OSFI’s March announcement that banks regulated by the federal government will be required to limit mortgages exceeding 4.5 times a borrower’s annual income or, in other words, those that have a Loan-to-Income (LTI ratio) of 450%.

OSFI previously stated that the new Loan-to-income limits Will help to “prevent the accumulation of heavily leveraged borrowers”.

SafeBridge Financial Group names new Vice President

SafeBridge Financial Group named Ryan Sadler its new vice president of strategic partnerships.

Ryan Sadler’s new role will be focused on three areas. He will enhance value for SafeBridge Mortgage Agents and form new partnerships with other mortgage professionals. And he will optimize the experience of clients through the private wealth services offered by the company.

Sadler stated in a press release that he was “thrilled” to be joining the leadership team of SafeBridge Financial Group. We share the same commitment in elevating the SafeBridge Brand and driving growth for the brokerage. “I look forward to working together with this talented group to provide exceptional value to clients, partners, and lenders.”

Chris Karram, the Chief Strategy Officer at SafeBridge, highlighted Sadler’s professionalism in a press release. He also emphasized Sadler’s alignment with SafeBridge’s values. Karram stated that “Ryan’s years of mortgage experience are not the only reason he is an industry leader.” His professionalism, integrity, and personal reputation have always impressed us. It was clear to us that he would be a great fit at our company.

Bank of Canada to cut rates in future if inflation rises higher than expected

The Bank of Canada has not yet announced when it will cut rates.

CPI median (up from 2.6% in April), and CPI trim (up from 2.8%) are also on the rise.

The largest component of inflation is housing costs, which are stable at 6.4% per annum. Rent inflation increased to 8.9% while mortgage interest costs decreased to 23.3%.

Douglas Porter, Chief Economist at BMO said that the results “clearly” represented a move in the wrong directions.

The outlook for BoC actions is also bumpy, with inflation on an uphill path. “For now, we remain committed to the September rate cut, which is our current official prediction. This report makes no difference in that regard,” wrote he.

TD’s James Orlando stressed that “one poor inflation print does not make a pattern” and that the inflation remained under 3%.

He said that it was a sign of unevenness in the return to 2%. The central bank is likely to wait until the end of September to make its second cut.