More Canadians face higher prices Change your grocery habits, Hunting for bargains You can also find out more about the following: Switching to cheaper brands Many people are still wasting money when they make their largest purchase.

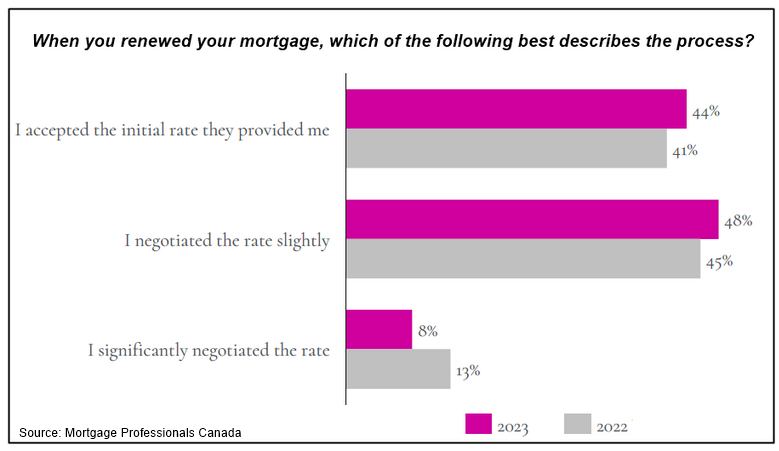

A recent survey Mortgage Professionals Canada conducted a survey that found homeowners haggling less at the renewal of their mortgages, even though most are facing higher rates.

In the study, 41% accepted their initial interest rate from their lender. This is up by 23% since two years earlier. Just 8% of borrowers say that they have “significantly” bargained their renewal rate, a drop by more than half from 2021 when 16% did so.

Robert Jennings, of St. John’s Newfoundland’s East Coast Mortgage Broker says that you’d expect people to shop more in response to’renewal-shock’. In the second half, mortgage rates were under 3%. The rates for mortgages coming up for renewal are now close to doubling.

Canadians leave money on the Table

Jennings said that the MPC statistics are frustrating, considering how much Canadians can save by shopping around or working with a broker. He believes that most people are not aware that they can negotiate rates and that the banks are more aggressive in reaching out earlier to their clients to lock them into higher rates.

Jennings notes that some bankers will even say, “hey, this is your renewal offer. If you find a lower rate, let me know and I’ll match it.” How unethical can that be? “You’re saying to someone, ‘Hey you’re probably not able to afford it, but we will give it to your anyway. We won’t give you our lowest rate unless we can find you a lower rate.

Jennings says that it is ironic for Canadians to spend hours on hold with telecommunications providers in order to get a better deal on their monthly phone, cable and internet bills but not do the same when they are looking at mortgages. He says that, like telecoms, most lenders reserve their best offers for new clients, which means there are usually better deals to be found elsewhere.

He says that if you are aware of this, then you need to have the attitude “I am going to change my mortgage” rather than, “I want to remain with my bank.” You should feel offended at the rates they charge.

Rate shopping can save you thousands for borrowers

Switching can result in significant savings. Nolan Smith, of TMG Oceanvale Mortgage & Finance in Nanaimo, B.C., says that a borrower who has a $450,000 loan with a fixed 25-year term, which is up for renewal at the end of their first five years, could find rates ranging between 4.79% and 5.5%.

He says that by choosing a different route, you can save $170 per month. This could be your grocery bill, or your gas. The balance at the end is $5,000 less, meaning you pay $5,000 more towards your principal and save $170 per monthly. That’s about $10,000 in five years. [in total].”

The cause of fear and anxiety could be the uncertainty

Smith claims that Canadians would not knowingly accept higher payments if a better offer was just a call away. He suggests many Canadians are doing so out of fear. Smith explains there have been many negative stories about the mortgage renewal rate in recent months, which could scare borrowers to take their first offer.

He says that when people are scared of what is happening, they tend to glom onto what they already know. It could be that people only listen to their institutions when they are scared.

A new Leger study found that six out of ten Canadians who hold mortgages — including 68% among those aged 18 to 34 — are stressed financially. Ron Butler, of Toronto’s Butler Mortgages, says that many are facing more challenging economic conditions and may be afraid to negotiate due to their concern about qualification.

He says that it’s unlikely to be a factor. There is a big difference between being afraid that someone might say “no” and not caring — I do not believe people are careless.

Butler is unable to accept the results of this survey, which suggest that Canadians haggle less in an environment with higher interest rates.

He says, “I don’t believe anyone today would sign the first loan offer they receive from their lender.” I think you are seeing a misinterpretation here.

Butler claims that contrary to survey results, more borrowers than ever are negotiating, but many of them end up signing with their current lender after they accept a lower rate elsewhere.

Butler, Smith, and Jennings advise that you should do some research to find the best deal. They also recommend shopping around, and working with a broker to explore all your options.

Butler advises: “Shop online and at different banks. Shop around.” There’s a lot of information online about mortgage rates. It’s easy to compare rates and terms today.